Wisconsin Tax Rates 2024

Wisconsin Tax Rates 2024. This comprises a base rate of 5% plus no mandatory local rate. Wisconsin sales tax rates & calculations in 2023.

Wisconsin sales tax rates & calculations in 2023. Wisconsin lowered the income tax rates of the state’s bottom two tax brackets effective jan.

The Wisconsin Sales Tax Rate Is 5% As Of 2024, With Some Cities And Counties Adding A Local Sales Tax On Top Of The Wi State Sales Tax.

How is income taxed in wisconsin?

The Wisconsin Sales Tax Rate In 2023 Is 5%.

This lookup does not identify all taxes that may apply such as municipal room taxes, state rental vehicle fee, etc.

2024 Income Tax Forms Corporation;

Images References :

Source: kayleighgough.z21.web.core.windows.net

Source: kayleighgough.z21.web.core.windows.net

Wisconsin Property Tax Credit Table, Wisconsin prior years' tax forms about us. Wisconsin lowered the income tax rates of the state’s bottom two tax brackets effective jan.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg) Source: www.investopedia.com

Source: www.investopedia.com

State Tax vs. Federal Tax What's the Difference?, This comprises a base rate of 5% plus no mandatory local rate. Updated for 2024 with income tax and social security deductables.

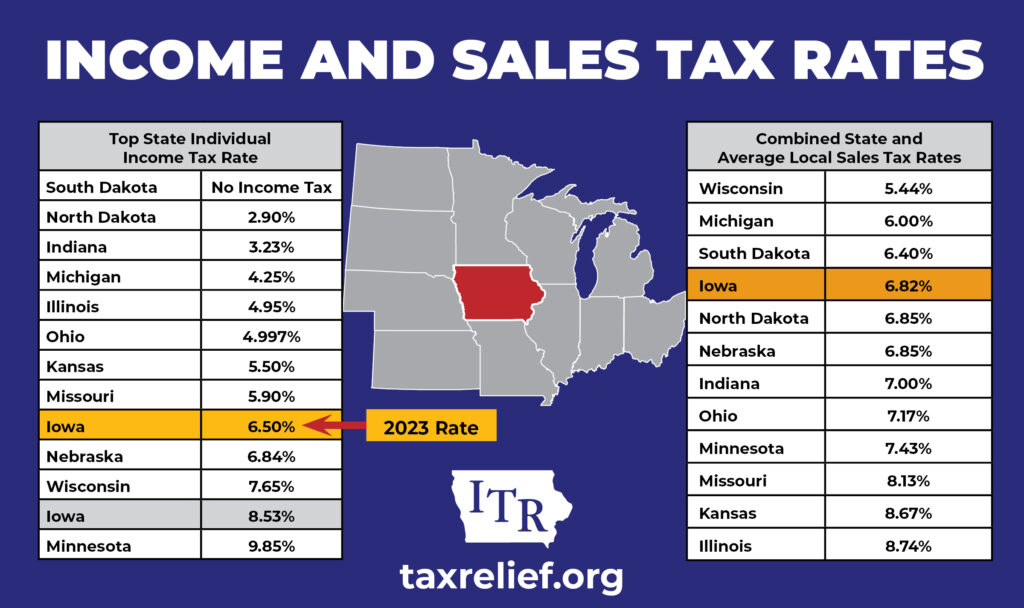

Source: taxrelief.org

Source: taxrelief.org

Midwest State and Sales Tax Rates Iowans for Tax Relief, Wisconsin prior years' tax forms about us. 2024 individual income tax forms note:

Source: www.taxrateinfo.com

Source: www.taxrateinfo.com

Wisconsin Tax Brackets and Rates 2021 Tax Rate Info, The next portion from $27,630to $304,170 is taxed at 5.30% ($14,657) finally, the remaining from $304,170 to $350,000 is taxed at 7.65% ($3,506) adding. Wisconsin has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 0.6%.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

110,000 a Year Is How Much an Hour? Top Dollar, The salary tax calculator for wisconsin income tax calculations. The wisconsin tax calculator includes tax.

Source: www.retirementliving.com

Source: www.retirementliving.com

Wisconsin Tax Rates 2023 Retirement Living, Downloadable files (for use by programmers): Unemployment insurance 2024 tax rates.

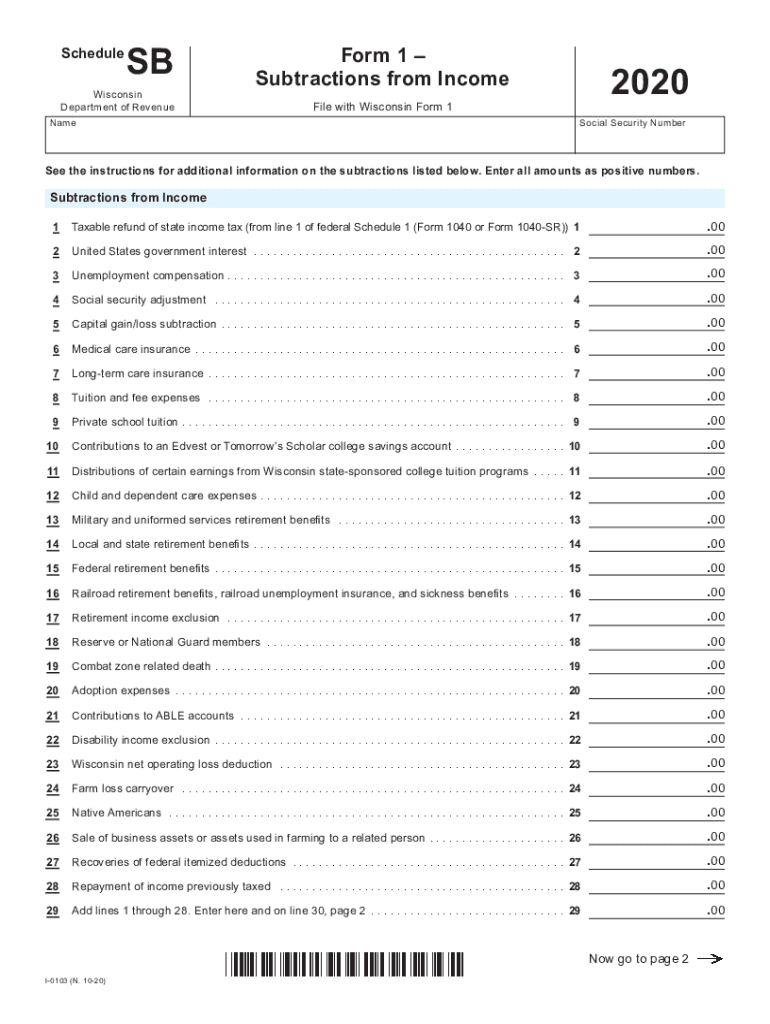

Source: www.signnow.com

Source: www.signnow.com

Wisconsin Schedule Sb Instructions 20202024 Form Fill Out and Sign, Wisconsin lowered the income tax rates of the state’s bottom two tax brackets effective jan. There is a statewide income tax in wisconsin.

Source: www.badgerinstitute.org

Source: www.badgerinstitute.org

Evers vetoes historic reforms to Wisconsin tax rates Badger, Wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. The state income tax rates range from 3.54% to a high of 7.65%.

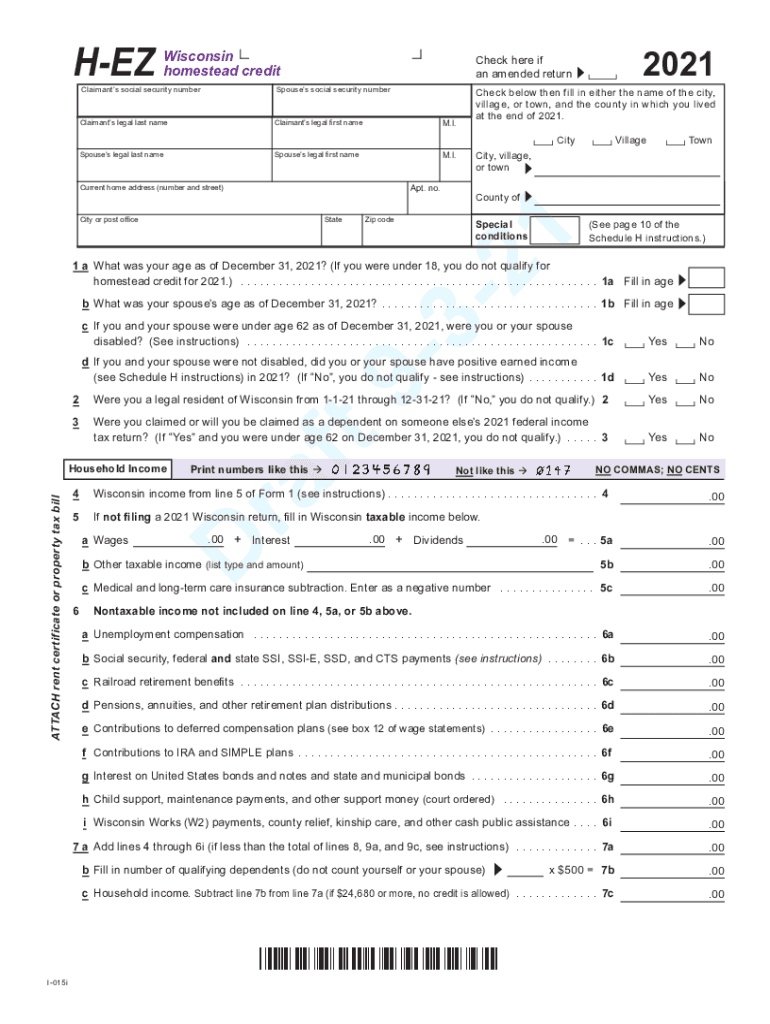

Source: www.signnow.com

Source: www.signnow.com

Wisconsin Homestead Credit 20212024 Form Fill Out and Sign Printable, Like the federal income tax, the wisconsin state income tax is progressive, meaning the rate of taxation increases as taxable income increases. The salary tax calculator for wisconsin income tax calculations.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, This tax is applied based on income brackets, with rates increasing for higher levels of income. 2024 individual income tax forms note:

Stay Informed About Tax Regulations And Calculations In Wisconsin In 2024.

Like the federal income tax, the wisconsin state income tax is progressive, meaning the rate of taxation increases as taxable income increases.

The Rate For The Lowest.

This page has the latest wisconsin brackets and tax rates, plus a wisconsin income tax calculator.